What's The Best Strategy For Avoiding Atm Fees?

What's the best strategy for avoiding atm fees?. Some banks and credit unions require customers to submit a request for reimbursement while others offer automatic reimbursement for ATM fees up to a certain amount per month. The Correct Answer is. Use these resources to.

To help you calculate how much money you have in your account. Opting for an in-network machine. This strategy is helping you to be an independent calculative person.

Prior planning of cash spending is the most effective strategy when you want to avoid ATM fees. The Correct Answer is. Whats the Best Strategy for Avoiding ATM Fees.

This is the simplest way you can avoid paying an out-of-network ATM fee and often even an ATM operator fee. This may seem like an obvious idea but sometimes a little bit of planning can go a long way. The best strategy for avoiding ATM fees involves planning ahead being creative and double-checking which banks charge for using out-of-network ATMs.

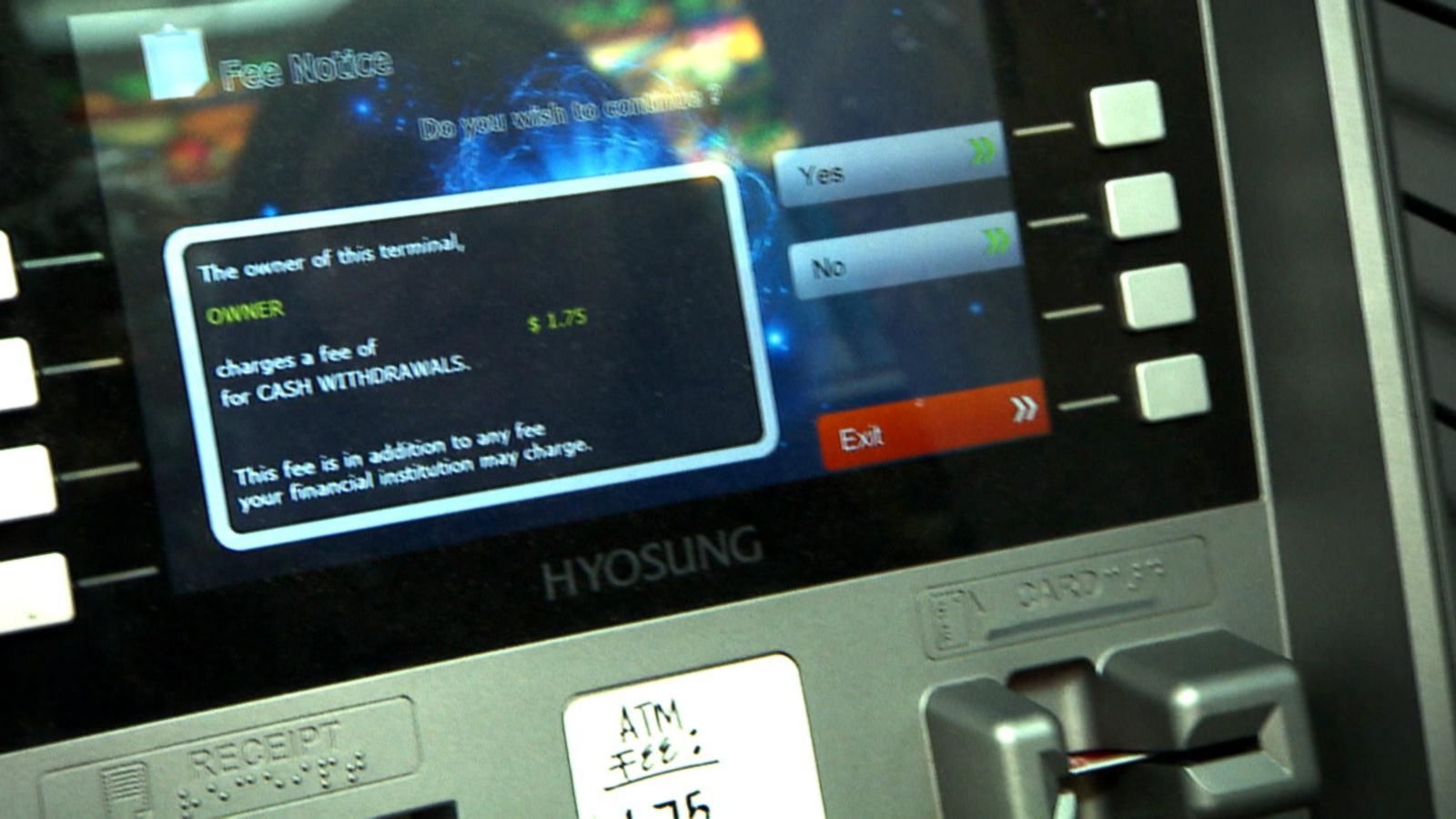

Your future spending planning is not only the valuable answer to your question. You may still be charged a withdrawal fee from the issuing ATM provider and these may be reimbursed up to 15 per month for some eligible customers. When you are going out for any trip you always list out your necessary items.

Best strategy for avoiding ATM fees. Whilst it seems impossible to dodge ATM fees there are some key strategies strategy for avoiding ATM fees. Only use ATMs in your banks network is correct for Whats the best strategy for avoiding an ATM fee.

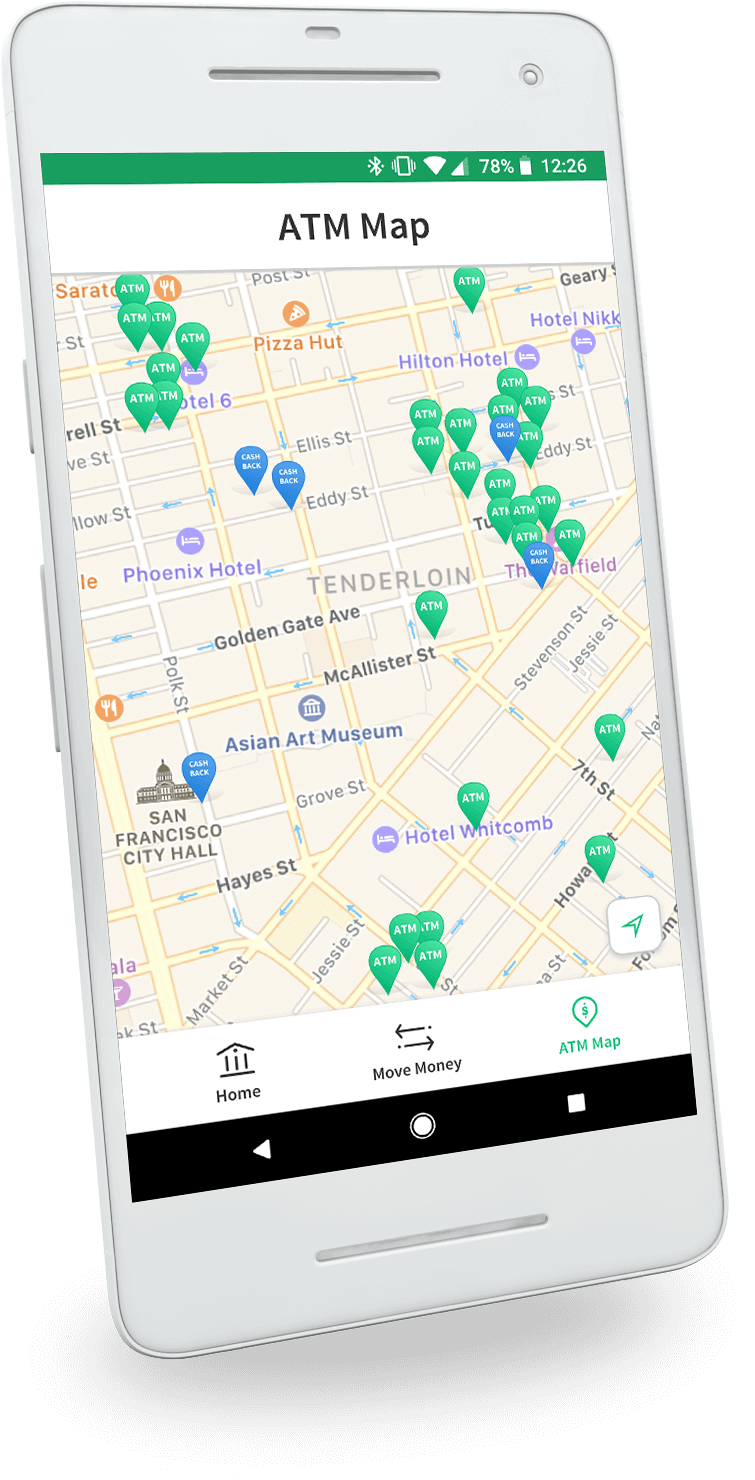

Try to plan ahead. With over 55000 ATM locations you can find one virtually anywhere by searching on the Allpoint location.

ATMs in your banks network.

Try to plan ahead. Use these resources to. Whats The Best Strategy For Avoiding ATM Fees. Opting for an in-network machine. Only Use Your Banks ATMs You can avoid the. To avoid ATM usage fees then use your debit card in an AllPoint ATM available in the United States Canada United Kingdom Puerto Rico Australia and Mexico. Using an out-of-network ATM once in a blue moon wont hurt you but with so many alternatives there is never a reason to pay ATM fees. With over 55000 ATM locations you can find one virtually anywhere by searching on the Allpoint location. Holders of some high-end accounts see fewer ATM fees from Citibank including waived non-network ATM fees from Citibank and third-party owners as well as waived foreign exchange.

When you are going out for any trip you always list out your necessary items. Whilst it seems impossible to dodge ATM fees there are some key strategies strategy for avoiding ATM fees. The best strategy for avoiding ATM fees involves planning ahead being creative and double-checking which banks charge for using out-of-network ATMs. You may still be charged a withdrawal fee from the issuing ATM provider and these may be reimbursed up to 15 per month for some eligible customers. ATMs in your banks network. Opting for an in-network machine. Your future spending planning is not only the valuable answer to your question.

/why-you-should-avoid-a-credit-card-cash-advance-960036_V3-c86fc4363fce48fa879fad484bde10d6.png)

/images/2020/03/02/man-using-atm.jpeg)

I have to agree with everything in this post. Thanks for sharing useful information. Learn more about turkish airlines cancellation policy

ReplyDelete